How to Write-off Your Equipment Purchases

In December 2015, Congress passed the Protecting Americans from Tax Hikes (PATH) Act. Part of this Act extended the provisions of two key tax depreciation incentives, the Section 179 expense election and bonus depreciation. Each of these provisions will provide taxpayers with the opportunity to accelerate tax depreciation deductions in the year of acquisition.

The Section 179 provision was permanently extended, while bonus depreciation was extended to 2019. These taxpayer-friendly provisions are designed to stimulate economic activity by encouraging businesses to invest in machinery and equipment.

What is Section 179?

Normally, an asset acquired and placed in service in a business is depreciated over a set period of time, for instance, five years. In these situations, taxpayers must wait the entire depreciation period to realize the full tax benefit of the tax depreciation deductions using regular tax depreciation. Section 179 provides a unique opportunity for taxpayers to expense up to 100% of the cost of an asset in the year of acquisition, rather than depreciating over a set period of time.

Internal Revenue Code Section 179 provides taxpayers with the ability to deduct up to the full purchase price of financed or leased equipment and off-the-shelf software that qualifies for the section 179 deduction.

There are a few limitations to this deduction, as follows:

- Section 179 assets must be placed in service in the year of acquisition.

- The maximum Section 179 expense is limited to $500,000 per year. This will be indexed for inflation in subsequent years.

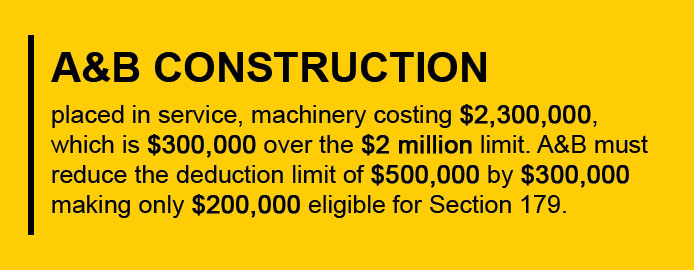

- Asset acquisitions for the year cannot exceed $2,000,000. To the extent acquisitions are above this threshold, the deduction is reduced dollar-for-dollar, up to $2,500,000. Above this amount, there is no Section 179 deduction available.

- New and used equipment qualify for this deduction.

- Section 179 may not be taken to the extent it creates a taxable loss in the business.

List of Eligible Equipment from Section179.org:

What is Bonus Depreciation?

Internal Revenue Code Section 168(k) provides taxpayers with the ability to deduct up to 50% of the full purchase price on purchases of qualified property. This particular provision contains the following specific requirements:

- Original Use – the original use of the asset must begin with the taxpayer claiming the deduction. This includes “new” assets, and rental assets which are acquired within the first three months of the rental period.

- Used assets acquired are not eligible for bonus depreciation.

- There is no asset acquisition threshold; therefore, this deduction may be applied to all qualifying assets acquired by the taxpayer during the year.

- Bonus depreciation may be taken to create a taxable loss in the business.

- Bonus depreciation may be used in conjunction with Section 179.

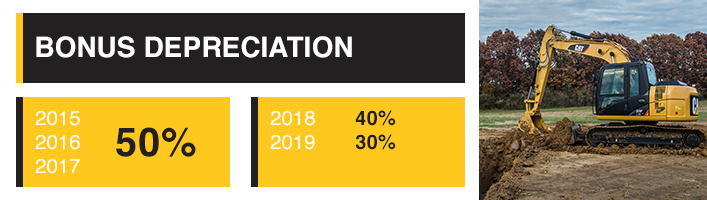

- Bonus depreciation was extended by the PATH Act, as follows:

The Acquisition

Limit is set at $2,000,000, so if the cost of your qualifying property is more than this amount, you must reduce the dollar limit of the deduction. For example:

What are the Differences between Section 179 and the Bonus Depreciation?

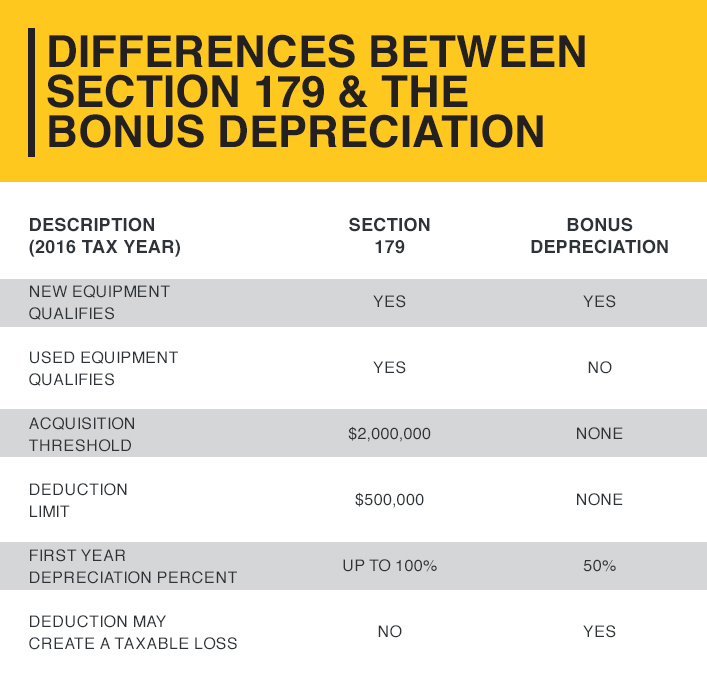

The following chart outlines some of the differences between Section 179 and Bonus Depreciation:

Act Now

To take advantage of these tax deductions for the 2021 tax year, you need to act before the end of this year.

Browse Current Used Inventory Explore New Machines